michigan sales tax exemption number

The following exemptions DO NOT require the purchaser to provide a number. Sales Tax Return for Special Events.

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

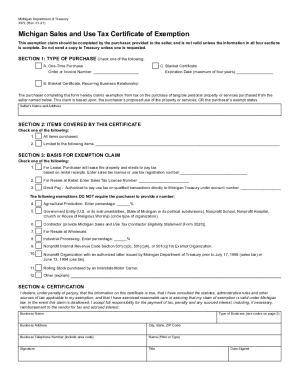

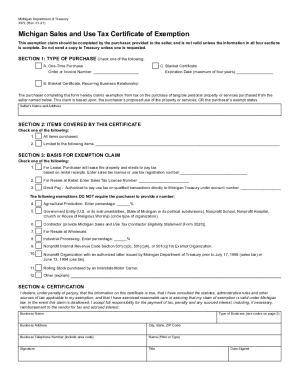

Michigan Sales and Use Tax Certificate of Exemption.

. If the retailer is expected to be purchasing items frequently from the seller instead of completing a resale. Church Government Entity Nonprot School or Nonprot Hospital Circle type of organization. You can also apply for a federal tax ID number by phone when you call 800 829-4933.

In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. The Arizona Government website allows a user to search for the resale certificate using the 8-digit tax license number. On november 4 2021 governor gretchen whitmer signed public act 108 of 2021 into law which exempted.

Obtain a Michigan Sales Tax License. 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act MCL 20595a. For Resale at Wholesale.

The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form 3372. 3372 Michigan Sales and Use Tax Certificate of Exemption Michigan Department of Treasury 3372 Rev. CityLocalCounty Sales Tax - Michigan has no city local or county sales tax.

DO NOT send to the Department of Treasury. Business hours for the phone application system are 7 am. Michigan Federal Tax ID.

03-16 Michigan Sales and Use Tax Certificate of Exemption INSTRUCTIONS. The following day on november 5 2021 the governor signed public act 109 of 2021 into law which further exempted feminine hygiene products. Fast Processing for New Resale Certificate Applications.

Instructions for Michigan Vehicle Dealers Collecting Sales Tax from Buyers who will Register and Title their Vehicle in Another State or Country. Sales Use and Withholding Tax Due Dates for Holidays and Weekends. 2019 Sales Use and Withholding Taxes Amended Annual Return.

Contractor must provide Michigan Sales and Use Tax Contractor Eligibility Statement Form 3520. Verification of tax-exempt resale certificate can be carried out through the official Alabama State website. You can also find form SS-4 on the IRS website.

Certificate must be retained in the sellers records. Michigan Department of Treasury Subject. Common Sales and Use Tax Exemptions and Requirements.

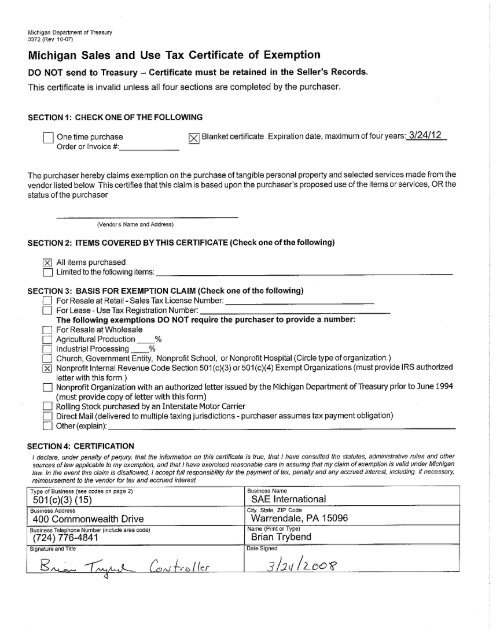

3372 Michigan Sales and Use Tax Certificate of Exemption Keywords 3372 Michigan Sales and Use Tax Certificate of Exemption Created Date. 501c3 and 501c4 Organizations 501c3 and 501c4 organizations must provide proof that they are exempt under these codes by the Internal Revenue Service. While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation.

Sales Use and Withholding Tax Due Dates for Holidays and Weekends. In addition to this they must provide a certificate of exemption stating that the property will be used or consumed in carrying out the. 3372 Michigan Sales and Use Tax Certificate of Exemption Author.

Michigan Sales and Use Tax Certificate of Exemption. Michigan Department of Treasury 5082 Rev. Steps for filling out the Michigan Sales and Use Tax Certificate Exemption Form 3372 Step 1 Begin by downloading the Michigan Resale Certificate Form 3372 Step 2 Indicate whether the transaction is a one-time purchase or a blanket certificate.

The state sales tax rate is 6. Michigan Sales and Use Tax Certificate of Exemption. Sales Tax Exemptions in Michigan.

Sales Tax Exemption Michigan. In order to claim an exemption from sales or use tax a purchaser must provide a valid claim of exemption to the vendor by completing one of the following. Retailers - Retailers make sales to the final consumer.

Instructions for Michigan Vehicle Dealers Collecting Sales Tax from Buyers who will Register and Title their Vehicle in Another State or Country. Several examples of exemptions to the states. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed.

The exemption certificate is 3372 Michigan Sales and Use Tax Certificate of Exemption. Ad Fast Online New Business Sales Tax Exemption Michigan. The Michigan Department of Treasury does not issue tax exempt numbers.

Sales Tax for Concessionaires If you will make. CST on Monday through Friday. This page discusses various sales tax exemptions in Michigan.

Michigan has a 6 statewide sales tax rate and does not allow. Therefore you can complete the 3372 tax exemption certificate form by providing your Michigan Sales Tax Number. Producers will note on item 4 in section 3 that you are to indicate the percentage of the purchase item is for agricultural production and that percentage would be exempt from sales tax.

Ranked 21st highest by per capita revenue from the statewide sales tax 852 per capita Michigan has a statewide sales tax rate of 6 which has been in place since 1933. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. This license will furnish a business with a unique Sales Tax Number otherwise referred to as a Sales Tax ID number.

You can easily acquire your Michigan Sales Tax License online using the Michigan Business One Stop website. The required information is Taxpayer ID Type Taxpayer ID and Exempt Sales Account Number. Once you have that you are eligible to issue a resale certificate.

Sales tax of 6 on their retail. Michigan sales tax exemption lookup. In order to register for sales tax please follow the application process.

03-16 Michigan Sales and Use Tax Certificate of Exemption. Michigan Department of Treasury 3372 Rev. If you have quetions about the online permit application process you can contact the Department of Treasury via the sales tax permit hotline 517 636-6925 or by checking the permit info.

All claims are subject to audit. Sales and Use Tax Exemption for Transformational Brownfield Plans. 04-18 Page 1 of 2 Issued under authority of Public Acts 167 of 1933 94 of 1937 and 281 of 1967 all as amended.

Visit the IRS website to get started. Get Your Michigan Sales Tax License Online. An application for a sales tax license may be obtained on our web site.

Sales Tax Return for Special Events. Municipal governments in Michigan are also allowed to collect a local-option sales tax that ranges from 0 to 0 across the state with an average local tax of NA for a.

Form 3372 Michigan Sales And Use Tax Certificate Of Exemption

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

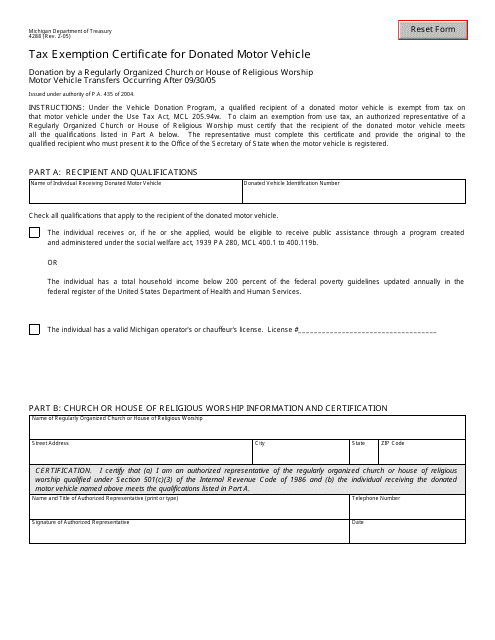

Form 4288 Download Fillable Pdf Or Fill Online Tax Exemption Certificate For Donated Motor Vehicle Michigan Templateroller

2021 Form Mi Dot 3372 Fill Online Printable Fillable Blank Pdffiller

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Get And Sign Form 3372 Michigan Sales And Use Tax Certificate Of 2021 2022

Michigan Sales And Use Tax Certificate Of Exemption

Michigan Sales And Use Tax Certificate Of Exemption Students Sae

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Fillable Online Utoledo 08t2 Michigan Sales And Use Tax Certificate Of Exemption Do Not Send To The Department Of Treasury Utoledo Fax Email Print Pdffiller